Maximizing Your Retirement Savings: 401(k) Catch-Up Contributions for 2025 and 2026

BlogTable of Contents

- What Is The Max Tfsa Contribution For 2024 - Ibby Randee

- TFSA Contribution Limit 2024

- Tax Rules 2024 - Lilla Patrice

- TFSA Limit 2024: All about TFSA Contribution Limit for year 2024

- IRS Delays Secure 2.0 Mandatory 401k Catch-up Contributions until 2026 ...

- New 2024 Contribution Limits Released by the IRS (401k, 403b, IRA, and ...

- Maximum 401k Employee Contribution 2024 - Venus Jeannine

- 2024 - Maximum TSP/401k and IRA contributions - YouTube

- 2024 401k Max Limit Fidelity - Vitia Karlen

- Max Tfsa Contribution For 2024 - Leena Myrtice

What are 401(k) Catch-Up Contributions?

2025 Updates

2026 Updates

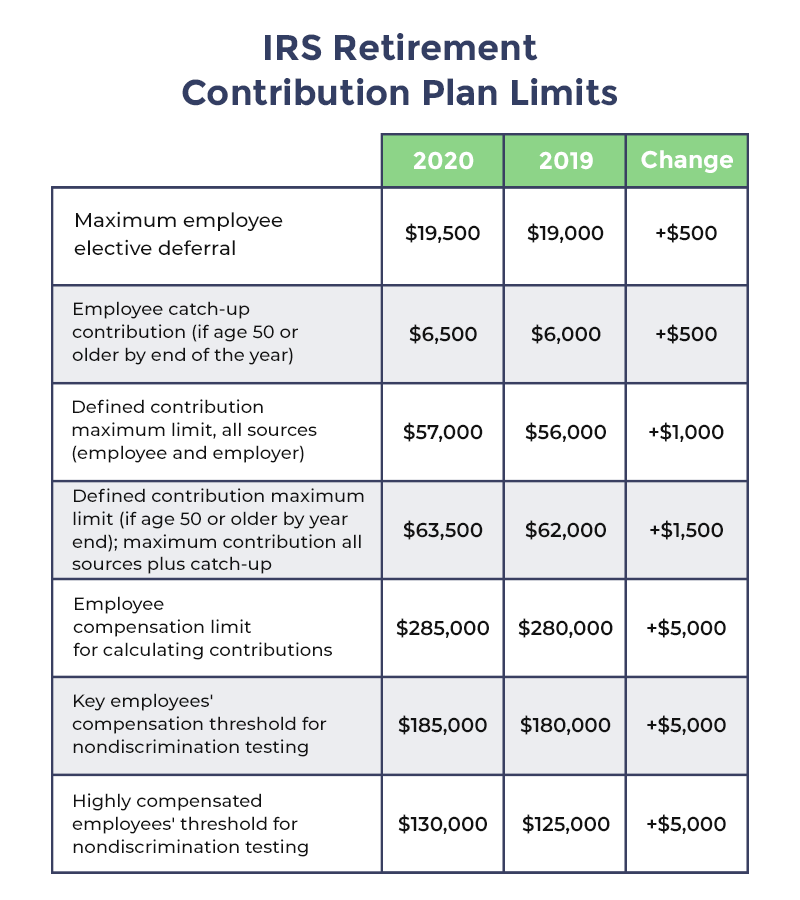

Looking ahead to 2026, the IRS has announced the following updates: The standard annual 401(k) contribution limit is expected to increase to $23,000, up from $22,500 in 2025. The catch-up contribution limit for individuals aged 50 or older is expected to increase to $8,000, allowing for a total annual contribution of $31,000 ($23,000 standard limit + $8,000 catch-up limit).

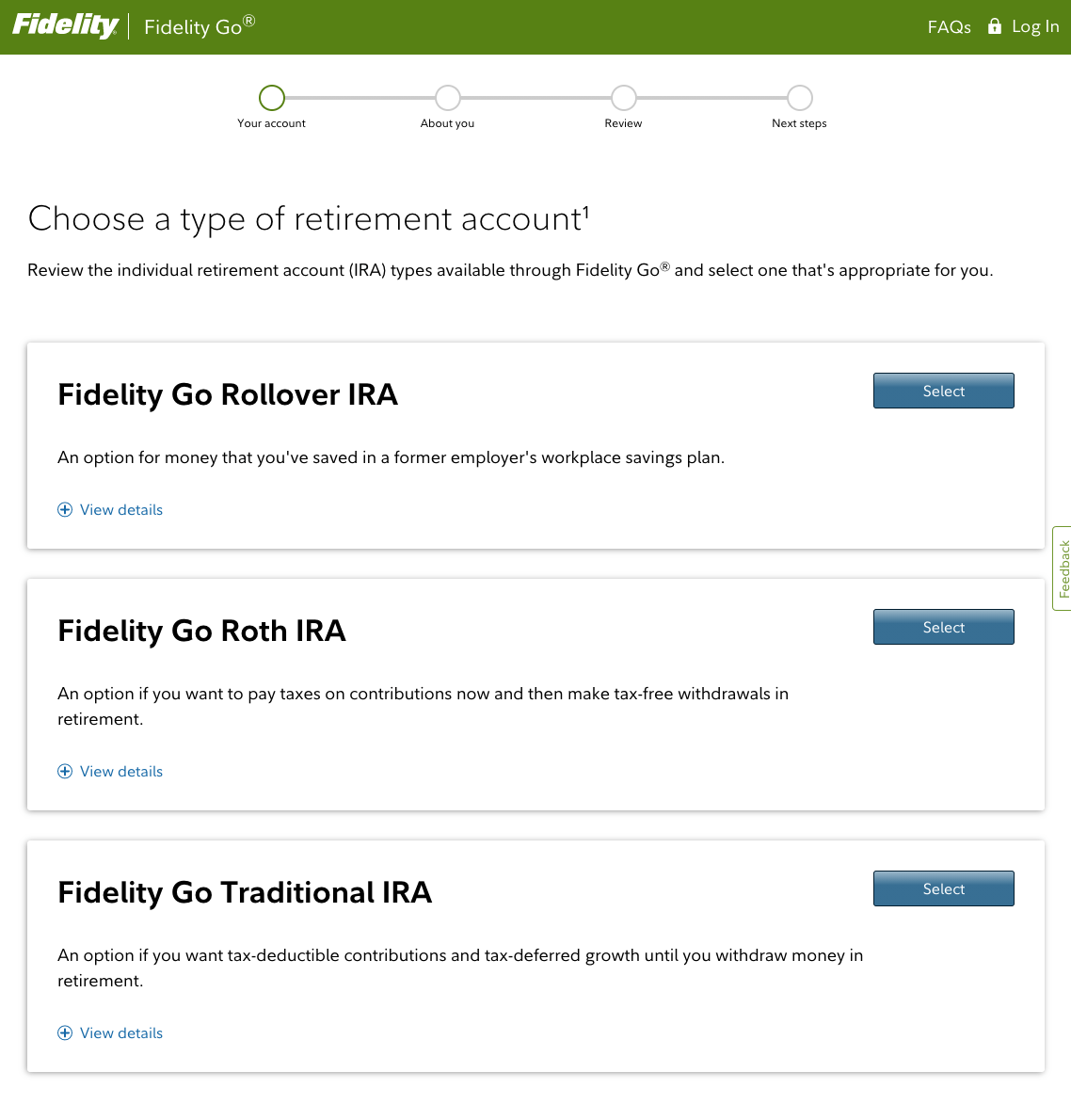

Key Considerations

When planning your 401(k) catch-up contributions for 2025 and 2026, keep the following points in mind: Age eligibility: You must be at least 50 years old to make catch-up contributions. Contribution limits: Be aware of the standard annual limit and the catch-up limit to avoid exceeding the total allowed contribution. Tax implications: Contributions to a traditional 401(k) plan are made pre-tax, reducing your taxable income for the year. However, withdrawals are taxed as ordinary income. Roth 401(k) options: If your employer offers a Roth 401(k) plan, you can make after-tax contributions, which can provide tax-free growth and withdrawals in retirement. 401(k) catch-up contributions offer a valuable opportunity for older workers to boost their retirement savings. By understanding the updates and limits for 2025 and 2026, you can make informed decisions about your 401(k) plan and maximize your benefits. Remember to review your individual circumstances, consider your overall financial strategy, and consult with a financial advisor if needed. Start planning today to make the most of your 401(k) catch-up contributions and secure a more comfortable retirement.Disclaimer: The information provided in this article is for general purposes only and should not be considered as professional advice. It's essential to consult with a financial advisor or tax professional to determine the best course of action for your individual circumstances.